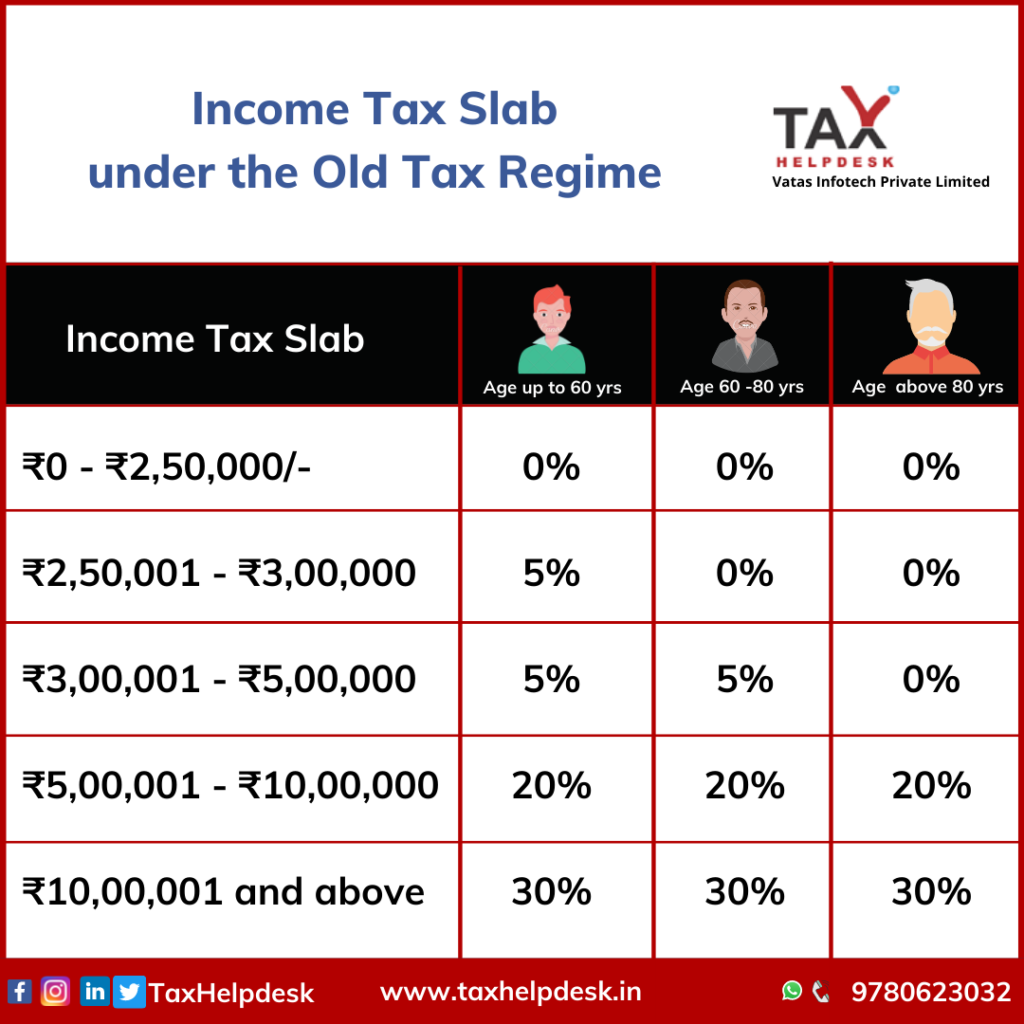

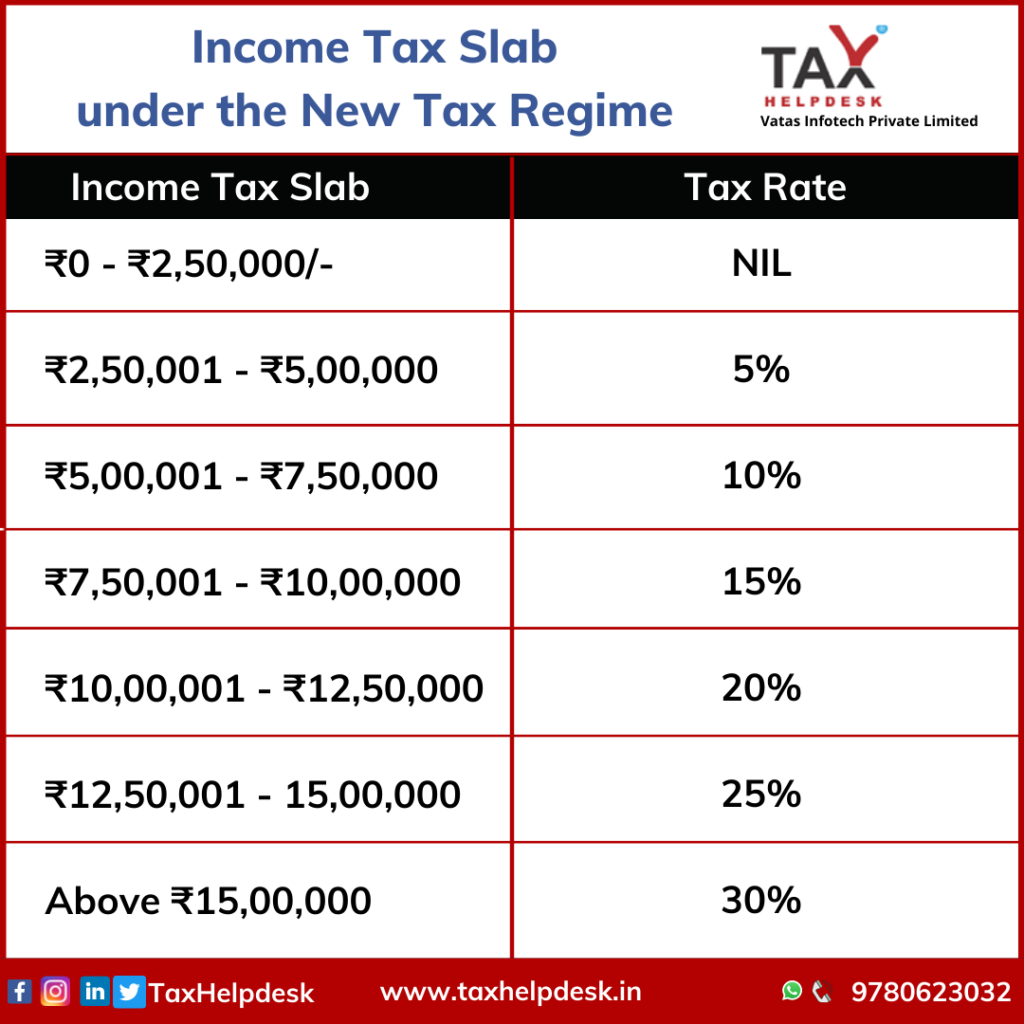

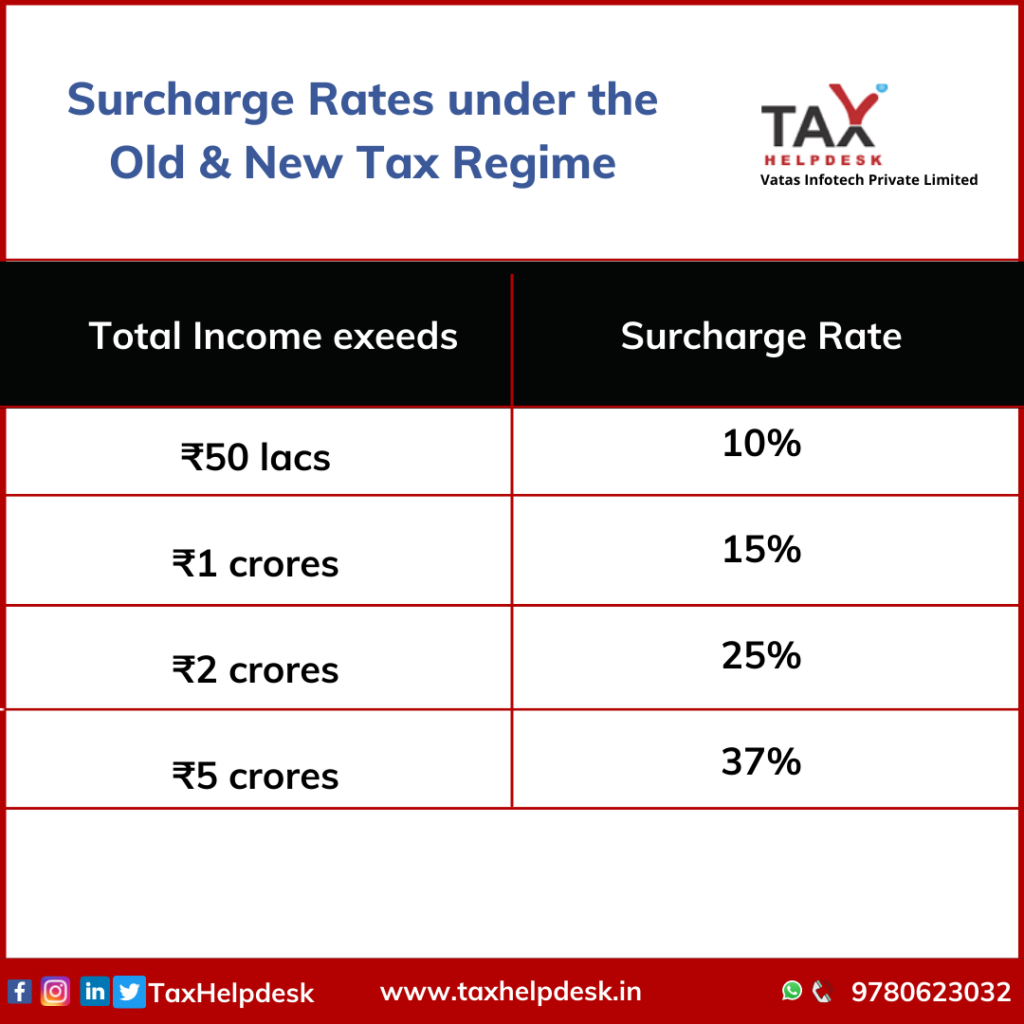

Income Tax Slab Rates For Individuals Under The Old And New Tax Regime

Income Tax is charged on the individuals as per the income(s) earned by them. The tax to be paid is Income tax is direct tax paid by the individuals depending upon the income(s) earned or achieved during the relevant financial year. The amount of the tax to be paid is decided by the Government and this is divided in various income tax slabs/rates. These rates are however, amended by Government from time to time.

Comments

Post a Comment