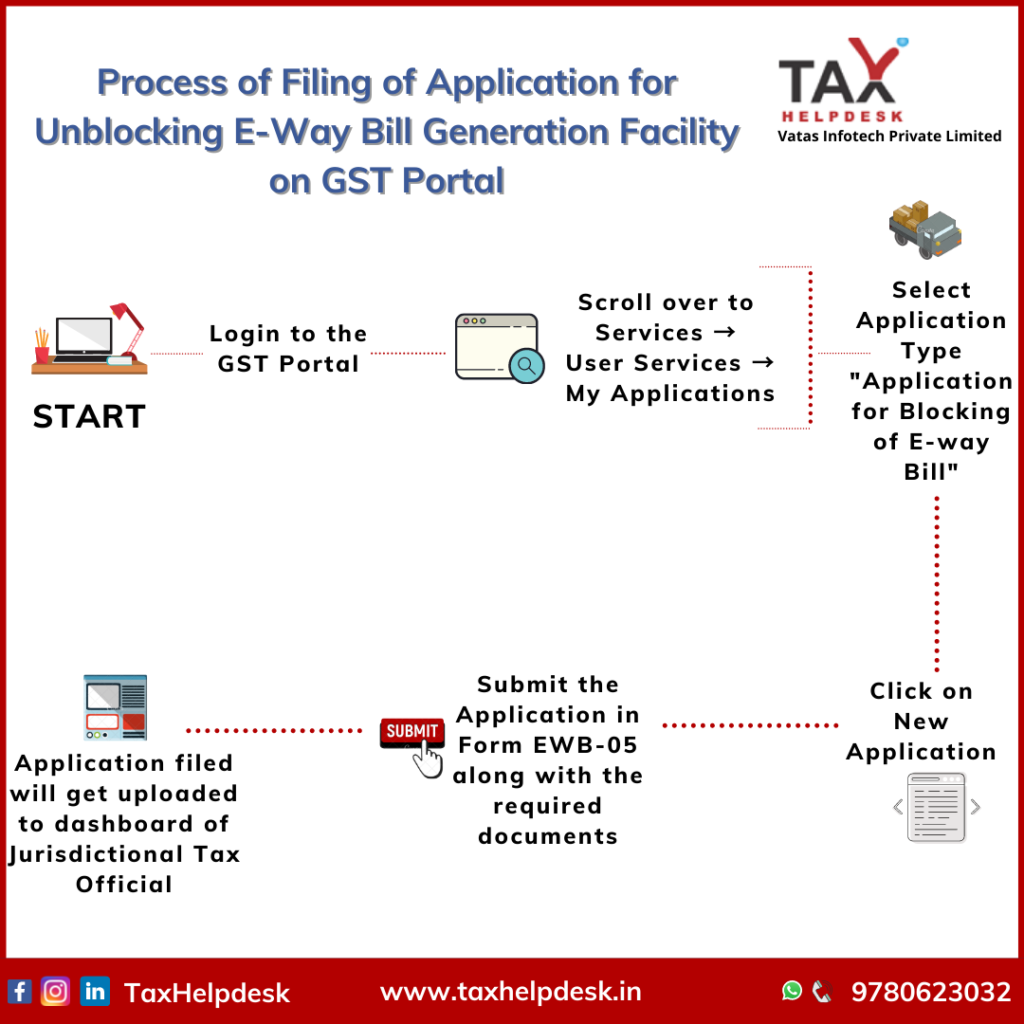

Step 1: Login to the GST Portal

Step 2: After logging in, scroll over to Services → User Services → My Applications

Step 3: Under My Applications, select application type as “Application for Blocking of E-way Bill”

Step 4: Click on “New Application”

Step 5: Now submit the application in Form EWB-05 along with the required documents

Step 6: On submission, the application filed will get uploaded to dashboard of Jurisdictional Tax Official

After following all the above steps, the Tax Officer can either accept or reject the application. If he chooses to accept the application, then the same will be approved through an order via Form EWB-6. On acceptance of the application, the e-way bill generation facility will be restored for the duration specified in the order. On the other hand, if the Tax Officer rejects the taxpayer’s application vide order in Form EWB-06, the EWB generation facility will remain blocked and the taxpayer shall be required to file their pending returns (in Form GSTR-3B / Statement in FORM CMP-08, so as to reduce the pendency to less than two tax periods), for restoration of the EWB generation facility.

If you have any suggestions/feedback, then please leave the comment below. For more updates on Taxation, Financial and Legal matters, join our group on WhatsApp or follow us on Facebook, Instagram and Linkedin!

Comments

Post a Comment