All About Changes In Employees’ Provident Fund Contribution Taxability

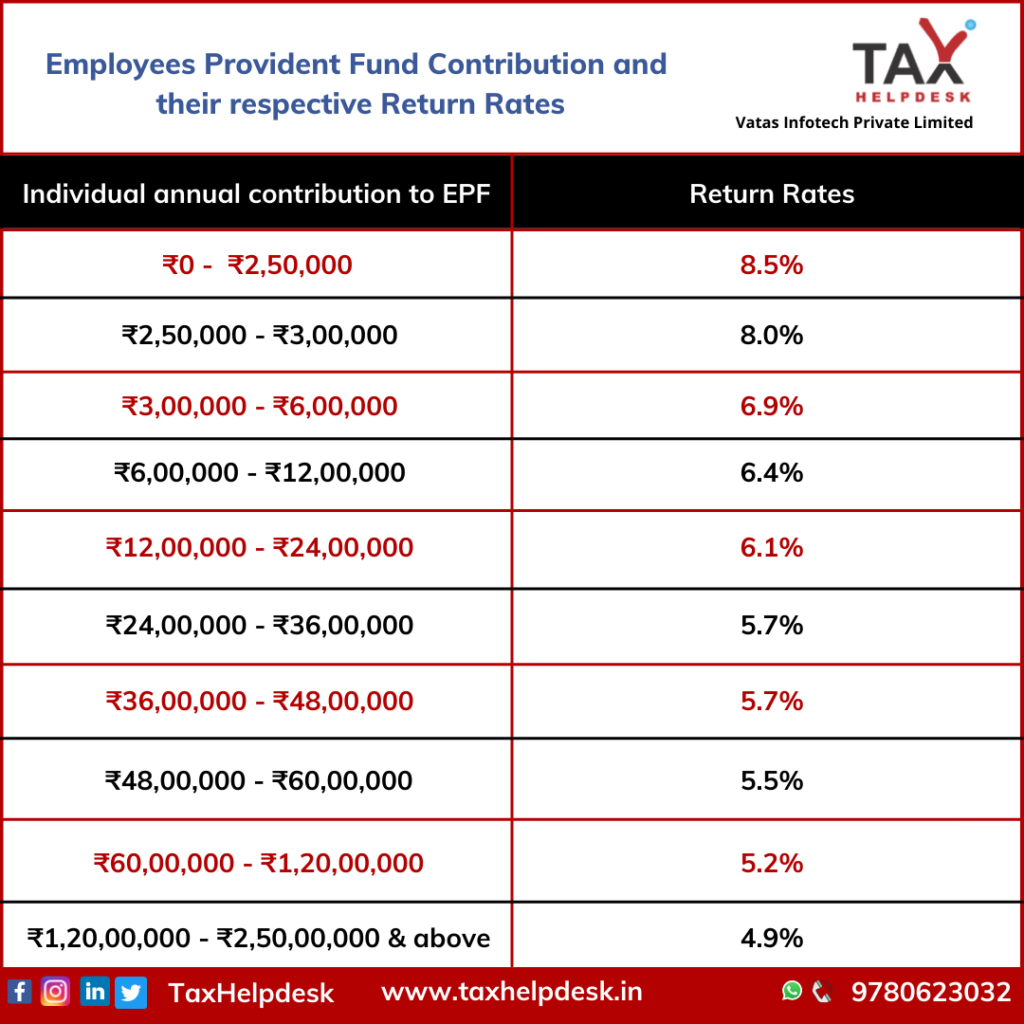

In the last year’s Union Budget of 2020, the Finance Minister Smt. Nirmala Sitharaman had capped the tax exemption on employers contribution to Provident Fund, National Pension Scheme and superannuation fund exceeding an aggregate of Rs 7.5 lacs per annum. And, in this year’s Union Budget of 2021, the Finance Minister proposed that interest on employee contributions to provident fund over Rs 2.5 lakh per annum shall be taxable.

Comments

Post a Comment